Medical tourism has, in recent years, become a major growth sector for the Asian travel and tourism sectors.

This does not really come as a surprise, given how travellers have made their way to the region over the centuries to seek out cures for a variety of maladies.

In the context of the 21st century, Asia has gained greater popularity as a destination for aesthetic medicine and cosmetic surgery, thanks mostly to surgical innovations offered in India and Thailand, as well as pharmaceutical advances from Japan and South Korea.

But medical tourism in the region goes far beyond the cosmetic and well into more specialised, life-saving specialisations like cardiology, oncology, pulmonary care, and even reproductive and fertility care.

In today’s feature, we take a closer look at the state of medical tourism within the Asia-Pacific, who the current key players are, and what the sector stands to evolve into.

Asia-Pacific Medical Tourism Market

Asia-Pacific Medical Tourism Market

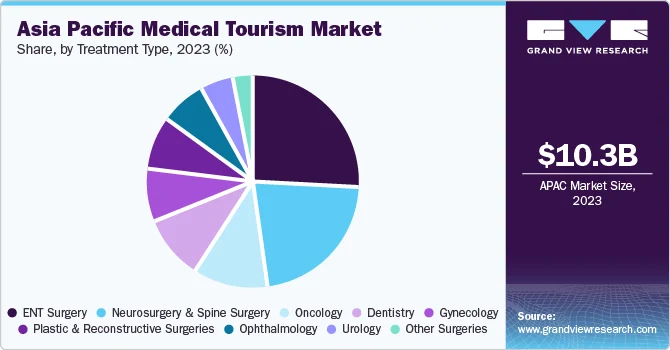

According to Grand View Research’s 2023 report, ENT surgery took up the lion’s share of the medical tourism market in Asia, followed by neurosurgery and oncology.

Why the world comes to Asia for medical care

Cost is the biggest factor driving patients, especially from western nations, to seek consultations and treatments in Asia. A 2024 report from Healthcare Asia noted that comprehensive treatment costs can drop by up to 80% in Malaysia, 40% in Singapore, and 75% in Thailand.

As a result, the Asia Pacific medical tourism market reached US$10.32 billion by the end of 2023 and is forecasted to grow at approximately 26.4% per year until 2030.

The availability of skilled medical professionals and specialised treatments at well-equipped facilities further encourages patient influx.

Key Players in the Asia-Pacific Medical Tourism Sector

- Apollo Hospitals Enterprise Ltd (India): Operates a network of 71 hospitals, specialising in lifestyle diseases and pharmaceutical innovation.

- Bumrungrad International Hospital (Thailand): Southeast Asia’s largest privately-owned hospital known for comprehensive medical care.

- Fortis Healthcare Ltd (India): Focuses on cancer treatment with more than 20 agreements with global health departments.

- KPJ Healthcare Berhad (Malaysia): Offers a complete approach to medical tourism including visa and post-procedure care.

- Raffles Medical Group (Singapore): Acclaimed for personalised care and significant overseas patient intake.

The downside is…

While medical tourism presents economic benefits, it also poses risks. Issues can arise from hospital-acquired infections, exposure to new pathogens, and prioritising foreign patients over locals.

The World Medical Association emphasizes the need for regulation to ensure safe practices and address the potential ethical concerns.

How Asia can do even better

Governments need to develop comprehensive protocols to manage medical tourism effectively, ensuring it does not negatively affect local healthcare resources or promote unethical practices.