Visa Unveils 2025 Remittances Report for Asia-Pacific Region

Global digital payments giant Visa announced the publication of its Money Travels: 2025 Digital Remittances Adoption Report on August 13. This study, drawing insights from 44,000 respondents across 20 nations, examines global remittance trends, prominently focusing on the Asia-Pacific, which constitutes a crucial part of the $905 billion remittance market.

Highlights of the Report

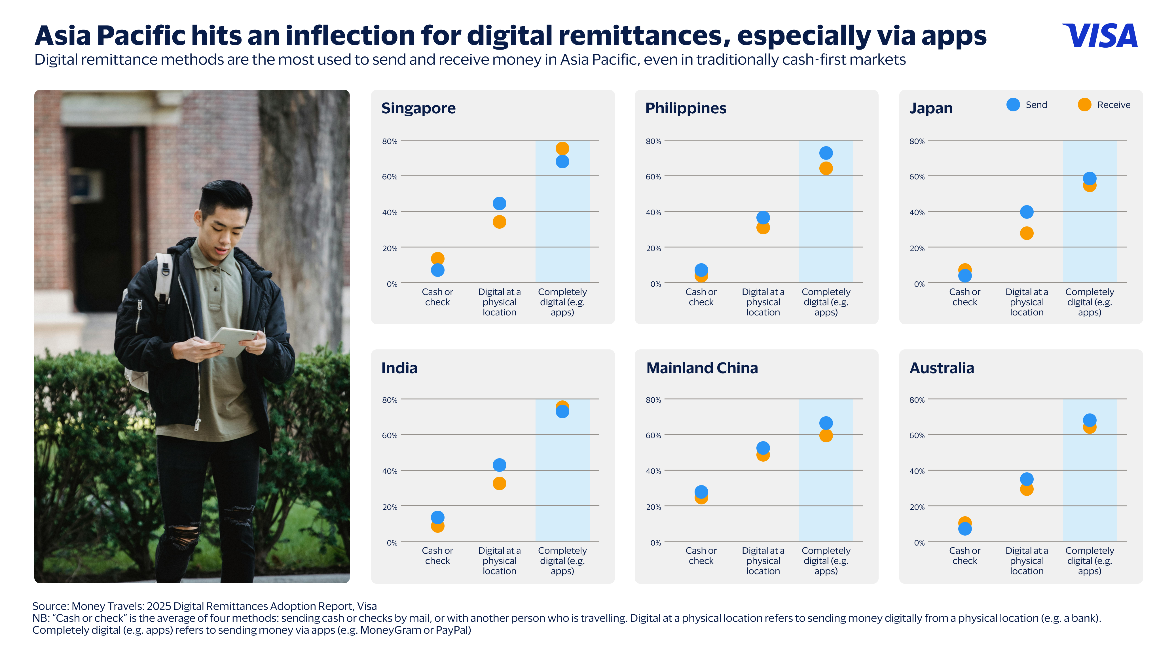

- The survey indicates that digital applications have emerged as the leading method for sending and receiving remittances. Respondents highlighted ease of use, safety, privacy, and security as key factors influencing their preferences.

Notable Insights for Asia-Pacific

- Popularity of Digital Apps: In several countries, digital apps are the preferred method for remittances—India tops the chart with 74% usage for sending and 76% for receiving.

- Regional Trends: Growth trends in Japan show a 10% increase in digital app adoption since last year.

- Perceived Speed: Over half of participants in countries like the Philippines, Australia, and Singapore view digital payments as the quickest method to access funds.

- Experience Satisfaction: Most users across Asia-Pacific reported minimal issues with sending and receiving funds digitally.

Regional Remittance Motivations

- People often send money to contribute to bank accounts or investments, especially in Mainland China and Singapore.

- Humanitarian needs drive remittances in nations like India and Australia.

User Concerns Prioritized

- Users identified the high fees associated with digital remittances as a primary pain point, particularly in the Philippines and India.

Call for Innovation

With a billion individuals depending on remittances each year, Visa aims to continually innovate and enhance its services to meet the evolving needs of users.

According to VP Rhidoi Krishnakumar, “Remittances have long been a lifeline across Asia Pacific, and they remain essential in supporting communities.”

Visa is actively working alongside global remitters like MOIN and WireBarley to enhance the efficiency of digital remittance processes.